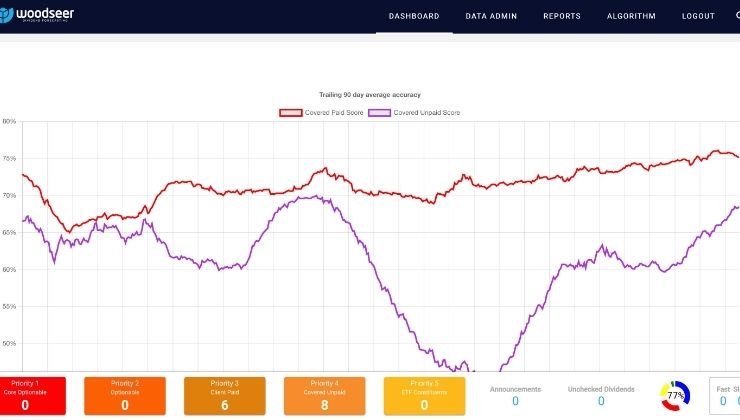

During my internship at a fintech firm using AI for dividend forecasting, I reviewed daily model runs to resolve discrepancies in predicted amounts, ex-dates, and cuts—cross‑checking outputs against political, economic, and company news and making informed manual overrides when needed. I wrote client press updates, expanded the coverage universe by onboarding new companies with fundamentals and risk profiles, and pursued self‑initiated projects, including two in‑depth articles linking macro/political trends to dividend strategies that were shared with 50,000+ clients—blending quantitative analysis, market research, and investor communications in a fast‑paced environment.

This internship confirmed that I want my career to combine my interests in economics and technology. I realized that I enjoy not just the technical side, but also the economic reasoning, market analysis, and investor-focused decision-making that come with portfolio management. This experience solidified my interest in pursuing roles that blend finance and AI, particularly in investment and portfolio management.

Prakriti Saxena

Senior | UC Berkeley | UK-England | Economics